With a staggering predicted growth of over 70% from 2020 to 2030, the European health insurance market provides a significant opportunity for Nordic insurance companies to thrive and expand. Factors such as rising healthcare costs, an increasing incidence of chronic diseases, and an aging population make this market an enticing venture for the industry.

But this growth also brings challenges. Insurance companies must be flexible and ready to face these challenges to make the most of the opportunities.

A growing market means growing competition

As the industry gets bigger, so does the competition. The main goal for insurance companies is to make sustainable and profitable business, offering excellent customer service. Achieving this requires strategic foresight and innovation.

Deciding on treatment approvals: a delicate balance

Central to health insurance is the cost of medical treatments. However, the most expensive treatments aren't necessarily the most effective.

Some clinics might suggest surgery, while others recommend physical therapy. It's important to remember that clinics are also businesses. They might suggest treatments based on what they specialize in.

We've spoken with many insurance customers. One common problem they mention is deciding if a treatment suggested by a doctor is needed. For example, how do they choose between surgery and physical therapy based on cost and patient safety?

The volume of treatment requests compounds this challenge. Insurance companies must decide which treatments to approve right away and which to review more closely. Decisions with substantial financial implications.

Mavera DSS: a new way to review medical cases

Mavera DSS is a market-leading solution tailored for personal injury claims and health insurance providers. Its ability to automatically evaluate treatment requests with precision sets it apart.

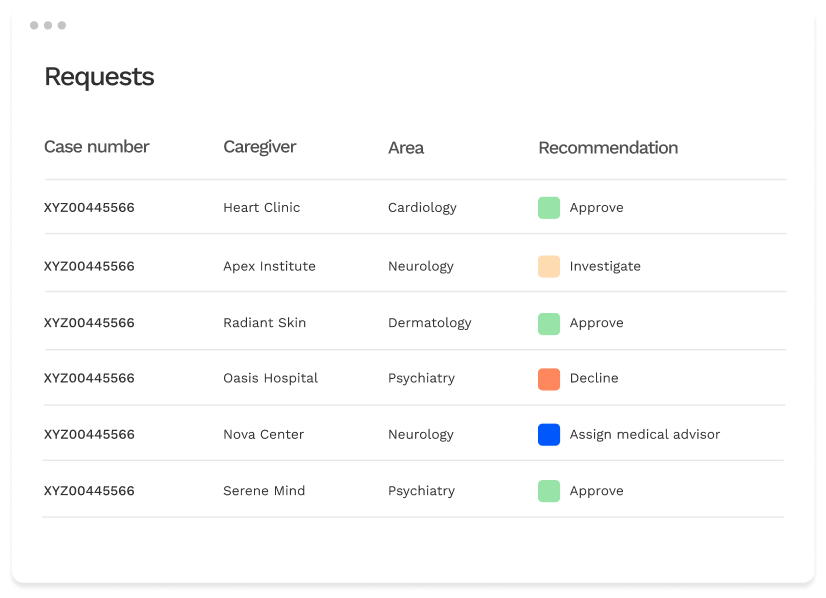

How it works:

- Mavera DSS is integrated with the insurance company's core system.

- Upon receiving a treatment request, Mavera DSS deploys AI technology to examine the case.

- It then suggests an action path: approve, decline, further investigation, or escalate to a medical advisor.

- From there, the insurer can decide what actions to automate further.

Thanks to Mavera DSS, some of our customers have reported annual savings of up to 1.9M€ and a notable increase in customer engagement.

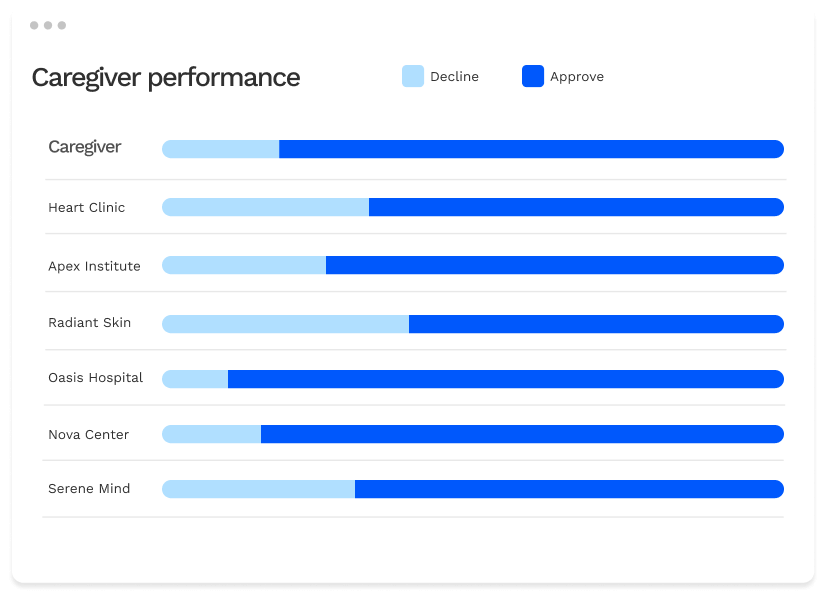

Caregiver performance reports for informed decisions

In building a sustainable health insurance business, reviewing individual claims is just one part of the equation. Adopting a broader, data-driven perspective is equally important. Mavera DSS meets this need with comprehensive reports on caregiver and doctor performance, enabling insurers to discern meaningful patterns among medical professionals. These reports highlight those with the highest approval rates and recognize those who frequently request treatments that may not be medically motivated.

Why it matters:

- Quality control: Understanding caregiver trends, supported by solid data, allows insurance companies to ensure clients receive the most appropriate and effective treatments. This approach not only benefits patients but also enhances the reliability and trustworthiness of the insurance provider.

- Cost savings: Data analytics is critical in tracking and analyzing treatment requests over time, revealing significant patterns. This empowers insurers to identify cost-effective caregivers, distinguishing them from those whose recommendations often lead to declines.

- Fostering accountability: Enhancing the healthcare process's accountability, this feature allows insurers to monitor caregiver performance. It enables them to follow up with those with a high rate of declined treatments, fostering a more transparent and responsible healthcare ecosystem.

Improving customer experience

At its core, insurance is about supporting customers during their most trying times. Emotional understanding is crucial, and when clients reach out, you aim to offer prompt but also empathetic and informed guidance.

However, health insurance claims are complicated. Spending time reading up on medical documents with a concerned customer awaiting a response is far from ideal.

Faster claim reviews with Mavera DSS

The AI-powered medical overview in Mavera DSS offers a solution, allowing claims handlers to review cases ten times faster. Using intelligent document processing technology, it finds and clearly visualizes the most important information from claim documents, including a summary and timeline of medical events.

This way, claim handlers can help customers quicker and more empathetic.

The road ahead

For product owners and insurance executives, the path is clear. The European health insurance market will grow, but to succeed, companies must use modern methods to manage claims.

By focusing on profitability and refining customer experience, insurance companies can navigate the challenges and turn them into competitive advantages. The future belongs to those who are ready to embrace change.

Mavera is here to help you on this path. Contact us to start planning your future together.

Learn more

Read more here to learn how to ensure optimal treatments for your customers and at the same time get actionable solutions for a more profitable health insurance business.